Rumored Buzz on Clark Wealth Partners

The Best Guide To Clark Wealth Partners

Table of ContentsSee This Report on Clark Wealth PartnersSee This Report about Clark Wealth PartnersIndicators on Clark Wealth Partners You Need To KnowThe Basic Principles Of Clark Wealth Partners The 5-Second Trick For Clark Wealth PartnersThe Greatest Guide To Clark Wealth PartnersThe Best Guide To Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.

Usual reasons to consider a financial expert are: If your financial circumstance has actually ended up being a lot more complex, or you do not have self-confidence in your money-managing abilities. Saving or browsing major life events like marital relationship, divorce, kids, inheritance, or task adjustment that might significantly affect your financial situation. Browsing the transition from conserving for retired life to preserving wealth during retirement and how to develop a solid retirement revenue strategy.New modern technology has actually led to even more detailed automated monetary tools, like robo-advisors. It's up to you to explore and figure out the ideal fit - https://www.reddit.com/user/clrkwlthprtnr/. Ultimately, an excellent monetary consultant needs to be as mindful of your financial investments as they are with their very own, avoiding extreme costs, conserving money on tax obligations, and being as transparent as possible regarding your gains and losses

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Gaining a commission on item recommendations does not necessarily imply your fee-based advisor antagonizes your benefits. But they may be more likely to suggest items and solutions on which they earn a payment, which might or might not be in your benefit. A fiduciary is lawfully bound to put their client's rate of interests first.

This typical permits them to make suggestions for investments and solutions as long as they fit their customer's goals, threat resistance, and economic circumstance. On the various other hand, fiduciary experts are lawfully obliged to act in their client's ideal rate of interest rather than their very own.

Examine This Report about Clark Wealth Partners

ExperienceTessa reported on all points investing deep-diving right into complex monetary subjects, clarifying lesser-known investment avenues, and revealing means readers can work the system to their benefit. As an individual financing expert in her 20s, Tessa is really familiar with the influences time and unpredictability have on your financial investment choices.

It was a targeted ad, and it functioned. Learn more Check out much less.

The Facts About Clark Wealth Partners Revealed

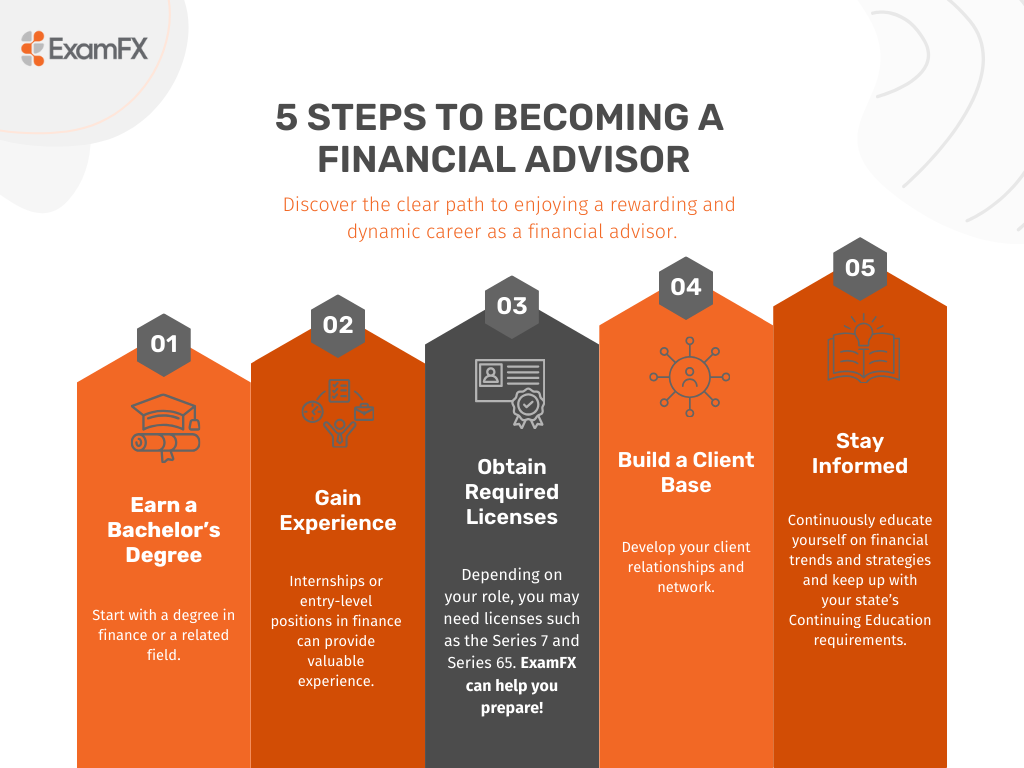

There's no solitary route to turning into one, with some individuals starting in banking or insurance policy, while others start in accounting. 1Most financial planners start with a bachelor's degree in money, business economics, audit, business, or an associated topic. A four-year level offers a strong foundation for professions in financial investments, budgeting, and customer service.

Some Known Incorrect Statements About Clark Wealth Partners

Common instances include the FINRA Series 7 and Series 65 tests for safeties, or a state-issued insurance coverage certificate for offering life or health insurance policy. While qualifications might not be legally required for all preparing duties, employers and clients usually view them as a standard of professionalism and reliability. We check out optional credentials in the following section.

Many economic planners have 1-3 years of experience and experience with monetary items, compliance standards, and direct client interaction. A solid instructional background is necessary, but experience demonstrates the capability to apply concept in real-world settings. Some programs incorporate both, enabling you to complete coursework while earning monitored hours via internships and practicums.

Some Known Incorrect Statements About Clark Wealth Partners

Early years can bring lengthy hours, pressure to construct a customer base, and the need to continually confirm your expertise. Financial coordinators delight in the possibility to work very closely with clients, overview essential life decisions, and frequently accomplish adaptability in routines or self-employment.

Wealth supervisors can raise their incomes via commissions, property fees, and performance benefits. Monetary managers oversee a team of monetary coordinators and advisers, setting departmental method, taking care of compliance, budgeting, and directing interior procedures. They spent less time on the client-facing side of the sector. Nearly all financial managers hold a bachelor's degree, and many have an MBA or similar graduate level.

5 Simple Techniques For Clark Wealth Partners

Optional qualifications, such as the CFP, normally call for extra coursework and testing, which can expand the timeline by a number of years. According to the Bureau of Labor Stats, individual financial consultants earn a typical annual annual wage of $102,140, with top earners gaining over $239,000.

In other districts, there are guidelines that require them to fulfill specific requirements to utilize the monetary expert or monetary coordinator titles (financial planner in ofallon illinois). What establishes some financial consultants apart from others are education, training, experience and credentials. There are many designations for economic experts. For financial planners, there are 3 usual classifications: Certified, Personal and Registered Financial Coordinator.

Clark Wealth Partners Fundamentals Explained

Where to find a financial advisor will certainly depend on the kind of advice you need. These institutions have Tax planning in ofallon il personnel who may aid you understand and buy certain types of financial investments.